(More likely that there will be a Dragon Stimulus 2.0 to go along with ours. -AM)

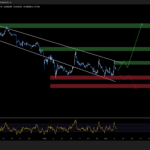

Sept. 1 (Bloomberg) -- The Shanghai Composite Index, the world’s worst performer in August, may fall another 25 percent as China’s economic recovery isn’t “sustainable,” former Morgan Stanley Asian economist Andy Xie said, adding that the index“should be 2000 or less.” The gauge rose 0.6 percent to 2,683.72 today.

“The market is in deep bubble territory,” Xie, 49, who correctly predicted in April 2007 that China’s equities would tumble, said in an interview with Bloomberg Television.

The Shanghai gauge slumped 22 percent in August, the biggest decline among 89 benchmark indexes tracked by Bloomberg, as banks reined in lending to avert asset bubbles and policy makers advised industries such as steel and cement to curb overcapacity.

“The local market bears are convinced that tightening is already underway,” said Howard Wang, head of the Greater China team at JF Asset Management, which oversees $50 billion. Only “a very strong set of macro numbers in August” or “stronger statements from central authorities” would change this trend, Wang said.

The government will maintain its fiscal and monetary policies because the economy faces many “uncertainties,” Premier Wen Jiabao said this month.

"Economic growth will slow in the fourth quarter as exports remain mired in a slump", Xie said.“The recovery is not sustainable.”

Xie resigned as Morgan Stanley’s chief economist in Asia in 2006 and now works as an independent economist.

China may have 200 billion yuan of new loans in August, the Beijing-based Caijing reported today on its Web site. That compares with 7.4 trillion yuan for the first half of 2009 and 355.9 billion yuan in July alone. The government plans to tighten capital requirements for financial institutions, three people familiar with the matter said this month.

An estimated 1.16 trillion yuan of loans were invested in stocks in the first five months of this year, China Business News reported June 29, citing Wei Jianing, a deputy director at the Development and Research Center under the State Council.

“The government is now pulling the plug on liquidity,” said Xie, who is a guest columnist for Caijing. “Hopefully, it’s not too late.”

No comments:

Post a Comment