(James Grant's Interest Rate Observer is always an anticipated read for this blogger. However an eyebrow did arch when I perused his article Saturday morning in the WSJ, 'From Bear to Bull.'

It seemed to be uncharacteristically slapdash and perhaps, conceptually, it was penned in anticipation of setting the tone at the Grant's conference which took place yesterday.

His first point:)

The deeper the slump, the zippier the recovery.

(That would certainly appear to be germane for the markets for as Rosie points out) ,

'Mr. Market has already moved to the bullish side of the debate having expanded valuation metrics to a point that is consistent with 4% real GDP growth and a doubling in earnings, to $83 EPS, which even the consensus does not expect to see until we are into 2012. We are more than fully priced as it is for mid-cycle earnings. '

(Or another way to look at it)

LEX Column

Financial Times

Sept 23

A fair price for an index equals the return on equity times book value per share multiplied by the price-to-earnings ratio. Using the long-run average p/e of 16 and book value per share of $451, the S&P 500 should trade at 867, or 18 per cent below today’s prices.

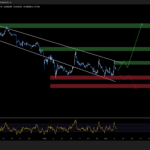

(So S&P broke the 2002 low and hit ~670. It is now at ~1070 and fair value is around ~870. Got symmetry?)

(The right honorable Mr. Grant's second point :)

To quote a dissenter from the forecasting consensus, Michael T. Darda, chief economist of MKM Partners, Greenwich, Conn.: "[T]he most important determinant of the strength of an economy recovery is the depth of the downturn that preceded it. There are no exceptions to this rule, including the 1929-1939 period."

(As a student of history, one might think Mr. Grant would look at that statement in an inverted fashion - for example, as written on this blog whilst imagining a conversation with Mr. Gann):

Gann :Your recent run from 1982 to 2000 was a bit larger in price gain than 1896-1929..and of course in less than half the time. However the 8 year bull in the 20s that ended on September 3, 1929 increased price by a factor of 6 while your 8 year run from 1992 to 2000 increased prices less than 4 times. After the greatest bull market in history, the greatest bear market in history must follow... my philosophy is that one must look back in order to determine how long the bear campaign might run. Going back over all the records, we find that the greatest bear market had lasted not more than 43 months and the smallest had been as short as 12 months. Some of them had culminated around 27 months,30 months,34 months and in extreme declines,anywhere from 36 to 43 months. You handed me cue cards describing the research since the Great Depression but I can't read your writing...'

AM : 13 recessions since 1929 lasted on average 10 months. The longest,the Great Depression, lasted 44 months. The third longest(1973-1975, 1981-1982) each lasted 16 months, and we're in the second longest and counting. How would you then compare our outcome given yours?

Gann : 'On July 8, 1932, the Dow Jones Averages made a low at 40 and 1/5. This was equal to the April 1897 low and was successfully tested. Several bear market lows were tested and broken on that campaign. In fact we can track a general uptrend of higher lows from this April 1897 and July 1932 low up through the May 2000 highs. This current bear market campaign with highs in March of 2000 and May of 2007 (2007 higher closing but lower intraday) has broken past support similar to our crash in 1929 and subsequent rally. The key will be to see what support holds. So far, the 2002 S&P 500 low of 768 obviously did not hold.'

(Relying on Mr. Darda for an economic prognostication should also carry a disclaimer that his crystal ball has resulted in broken glass being served, for example:)

WSJ

March 13, 2007

By Michael Darda

The Expanison continues

The latest jobs report is further evidence that the doomsayers aren't right about the state of the U.S. economy...

As always, prosperity has its discontents. With profits and productivity strongly outperforming compensation for most of this cycle, many of the usual suspects have emerged to call for higher tax rates on upper earners, caps on executive pay and other "equalizing" measures. But history shows that profit and productivity cycles always revert to the mean, with compensation playing catch up as the demand for labor rises and unemployment rates fall.

Some argue that the problems in the sub-prime mortgage market and manufacturing are only the beginning of a much broader and more intense slowdown that is likely to undermine the labor market and stifle consumption.

As the drags from housing and manufacturing abate sometime later in 2007, it is more likely than not that the economy will return to an above-trend growth rate powered by strong consumption (via a tight labor market), strong global growth (exports) and a pickup in capital spending (thanks to record profits and still-tight credit spreads).

(I am not sure why Mr. Grant keeps on calling Darda a non-conformist...)

(And Mr. Grant's third point ...)

Economic Cycle Research Institute, New York, which was founded by the late Geoffrey Moore and can trace its intellectual heritage back to the great business-cycle theorist Wesley C. Mitchell. The institute's long leading index of the U.S. economy, along with supporting sub-indices, are making 26-year highs and point to the strongest bounce-back since 1983.

(That certainly seems like a good indicator, however ...)

NEW YORK, Sept 18 (Reuters) - A weekly gauge of future U.S. economic growth rose to a level last seen one year ago, while its annual growth rate hit a fresh record high, feeding hopes of a recovery immune to looming economic threats.

The Economic Cycle Research Institute, a New York-based independent forecasting group, said its Weekly Leading Index rose to 126.2 in the week to Sept. 11 from an upwardly revised 126.0 the prior week, a figure ECRI originally reported as 125.4.

It was the group's highest index reading since Aug. 29, 2008, when it was 126.3.

(How did September 2008 turn out? Although the ECRI is a black-box it has been reported that stock prices are weighted as a forward indicator ...

Mr. Grant's conversion would be more persuasive if he had bothered to articulate how with falling rents, wages and house prices, large and growing structural employment, and stifling debt levels the recovery will zip up to what Mr. Market is pre-calculating.

Or perhaps surprise,surprise, once again, Mr. Market is Miscalculating. )

No comments:

Post a Comment